Can an Indian PayPal account Pay in Indian Rupees to other PayPal Account? Understand all the three use case scenario in detail

There are multiple scenarios when making a payment in Indian Rupees on Paypal. In some cases, you have the option to pay in Indian Rupees, but not always.

Let me discuss each such case and help you understand when one can make a payment from an Indian PayPal account to other PayPal account in India.

Scenario 1: Payment From Indian PayPal Account to an Overseas PayPal Account

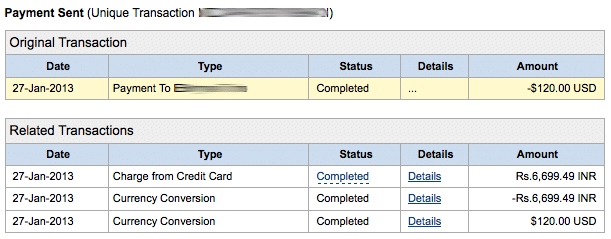

The first option is an Indian PayPal account making a payment to a foreign PayPal account. Indians can’t use the PayPal balance (amount received from non-Indian PayPal accounts) to make such payments. So one has to use a credit card to fund such transactions.

Payment is in a currency other than Indian Rupees. However, one can change the currency to INR. It only means you know the upfront INR amount that will be charged on your credit or debit card. However, you still lose a lot on Forex because of higher PayPal Forex rates.

However, if you keep the currency anything but INR, you may end up paying the forex charges to the bank instead of to the PayPal. In either case, the transaction is high on fees and forex charges.

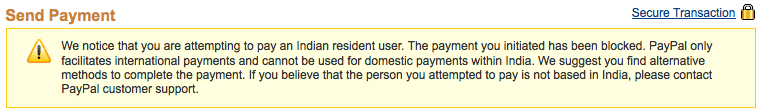

Scenario 2: Payment to and from an Indian PayPal Account

Indians are not allowed to pay fellow in Indian Rupees through PayPal. So you have to look for alternative payment methods.

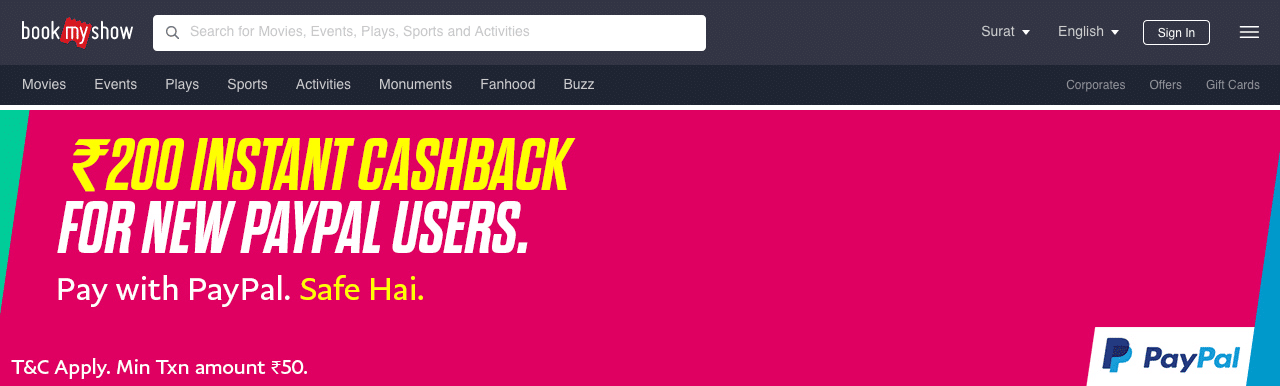

There is one scenario where if the other Indian PayPal account has an Indian seller account, then one can make payment via PayPal. BookMyShow offers PayPal as the payment method, and Indians can pay via PayPal.

Scenario 3: Receiving Payments From Foreign PayPal Account to an Indian PayPal Account

Receiving payments in India from foreign clients is possible, but there are two points to consider.

- Indians can’t receive personal payments. All Payments have to be business payments, which means each transaction has a fee associated with it.

- Indians cannot use the funds in their PayPal account for payments. They have to withdraw the amount received to their bank accounts. For payments, they have to use a credit card.

Again, because of bad forex rates and very high fees, it is always recommended to use Payoneer or PingPongX for payments from clients in India.

Coming back to Original Question of Can Someone Pay in Indian Rupees on PayPal?

The answer is if you cannot pay other Indian accounts, I don’t see a need to be paying in Indian Rupees. Still, one can pay to global clients in INR using a credit card but not using PayPal balance.